how does hawaii tax capital gains

Hawaii law requires all closing agents to withhold 725 of the sales price from the proceeds of non-resident sellers. The bill has a defective effective date of July 1 2050.

How High Are Capital Gains Taxes In Your State Tax Foundation

Only 50 of capital gains are taxed.

. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate. TAX FACTS 97-4 Tax Facts is a publication that provides general information on tax subjects of current interest to taxpayers and is not a substitute for legal or other professional advice. The highest rate reaches 11.

What is the actual Hawaii capital gains tax. Below we have highlighted a number of tax rates ranks and measures detailing Hawaiis income tax business tax sales tax and property tax systems. Only 75 of capital gains are taxed.

Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Hawaii Capital Gains Tax. For complete notes and annotations please see the source below.

Short-term gains are taxed as ordinary income. Also keep in mind that the long-term capital gains rate for. California taxes capital gains as ordinary income.

Hawaii taxes gain realized on the sale of real estate at 725. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly.

The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. State Tax Preferences for Capital Gains. If the appropriate Hawaii income tax return ex.

But this might require some waiting. The Hawaii capital gains tax on real estate is 725. Each states tax code is a multifaceted system with many moving parts and Hawaii is no exception.

Capital gains are taxed at 72 lower than rate for ordinary income of up to 11. In addition to short-term capital gains long-term capital gains may be taxable as well. 745 Fort Street Suite 1614 Honolulu HI 96813.

In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding. This applies to all four factors of gain refer below for a discussion of the four factors. Long Term Capital Gains Tax Brackets for 2021 It should also be noted that taxpayers whose adjusted gross income is in excess of 200000 single filers or heads of household or 250000 joint filers may be subject to an additional 38 tax as a net investment income tax.

Use this calculator to estimate your capital gains tax. Credit of 2 of capital gains. The first step towards understanding Hawaiis tax code is knowing the basics.

Deduction of 50 of capital gains or up to 1000 whichever is greater. Capital gains tax in Hawaii is set to increase to 11 percent if legislation is passed currently. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

How Much Tax Do You Pay On Real Estate Capital Gains. The highest rate reaches 133. The 10 states with the highest capital gains tax are as follows.

Short-term capital gains are taxed at the full income tax rates listed above. Form N-15 for the year is available then the owner should file the appropriate tax return instead of. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii.

Hawaiis capital gains tax rate is 725. Hawaii taxes capital gains at a maximum rate of 725. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

How does Hawaii rank. In order to insure collection of this tax and any other taxes you owe may owe the state. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Hawaii Financial Advisors Inc. According to Hawaiis capital gains tax a capital gain is taxed at the highest level.

After federal capital gains. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Hawaii taxes capital gains at a lower rate than ordinary income.

The amount withheld can be 2 3 even 10 times more than justified. An asset held for over a year is subject to long-term capital gains tax. The information provided in this publication does not cover every situation and is not intended to replace the law or change its meaning.

In Hawaii capital gains on real estate are subject to a 75 tax. That applies to both long- and short-term capital gains. Long-term gains are those realized in more than one year.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The state of Hawaii will keep your money if you do not submit the appropriate.

A bill is under consideration that would increase the capital gains tax in Hawaii from 10 to 11 percent if approved. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above. Does Your Child Need to File an Income Tax Return.

Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Capital gains at all levels including long- and short-term ones. You do this by filing a non resident Hawaii Income Tax form known as Form N15.

If the collected amount is too large how do you obtain a refund. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. Compared with other states Hawaii has a 73 capital gains tax rate.

States With the Highest Capital Gains Tax Rates. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. The difference between how much is withheld and how much is owed is the amount of your refund.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. HOW MUCH IS OWED IN HAWAII CAPITAL GAINS TAX. Taxes in Massachusetts would rise by 0 as well.

The Hawaii capital gains tax on real estate is 725. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

Pin By The Agency Team Hawai I On Hawaii Real Estate In 2022 Hawaii Real Estate Big Island Estates

Biden Trickle Down Economics Has Never Worked Axios In 2021 Trickle Down Economics Economics Capital Gains Tax

Historical Hawaii Tax Policy Information Ballotpedia

Filing Hawaii State Tax Things To Know Credit Karma Tax

Hawaii Income Tax Calculator Smartasset

5 Places That Could Become U S States Travel Trivia In 2020 Puerto Puerto Rico Tax Free States

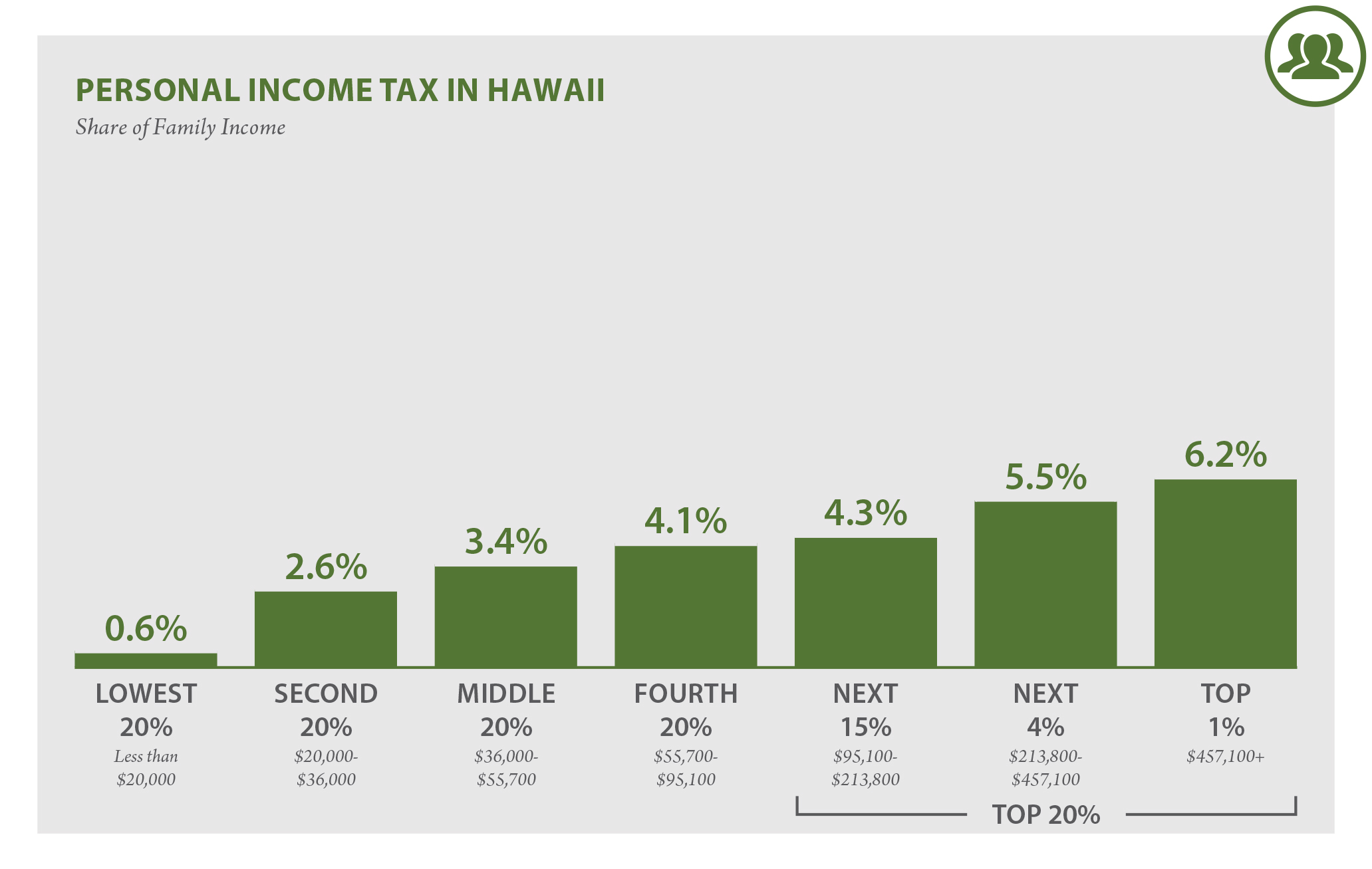

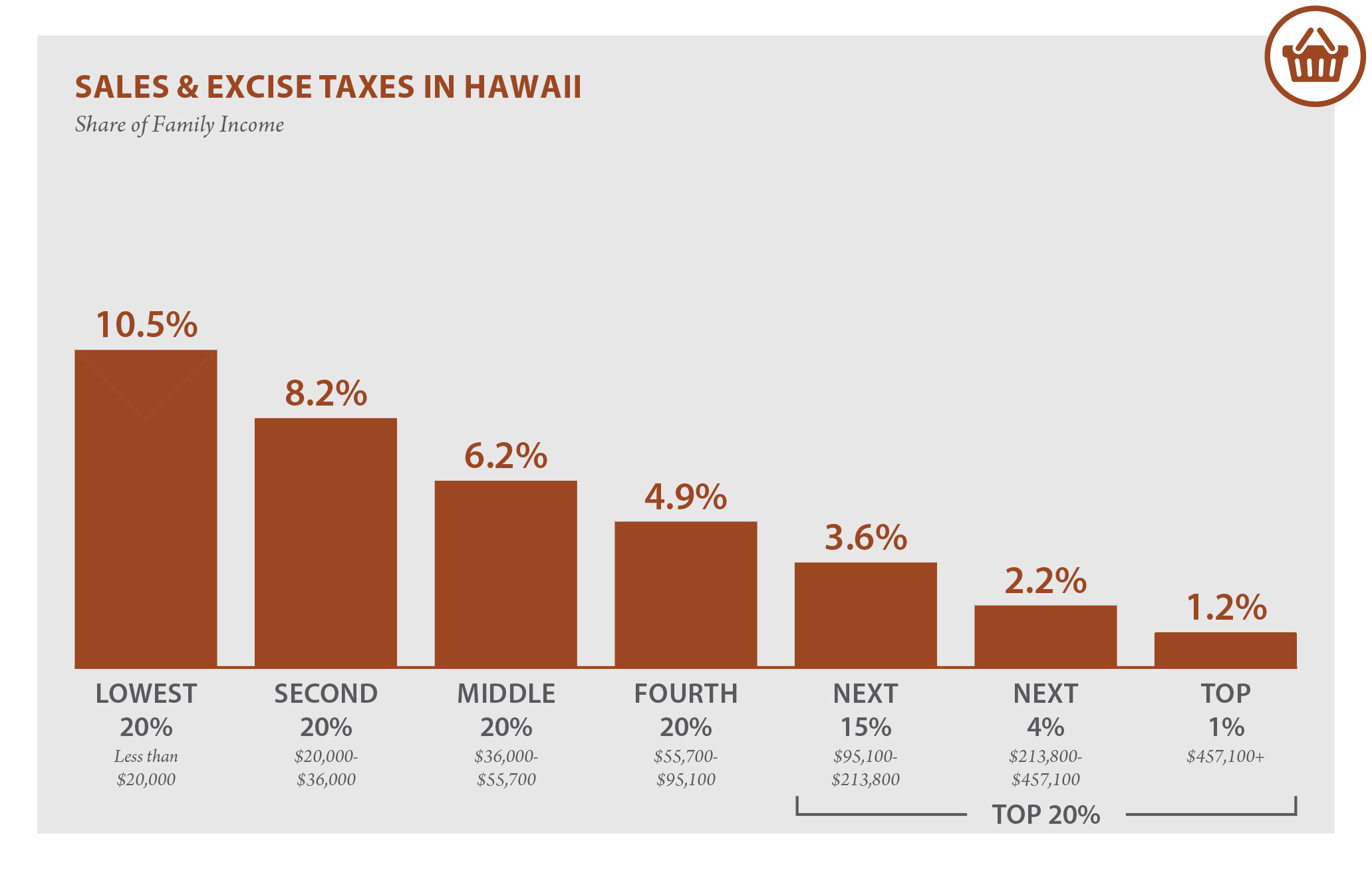

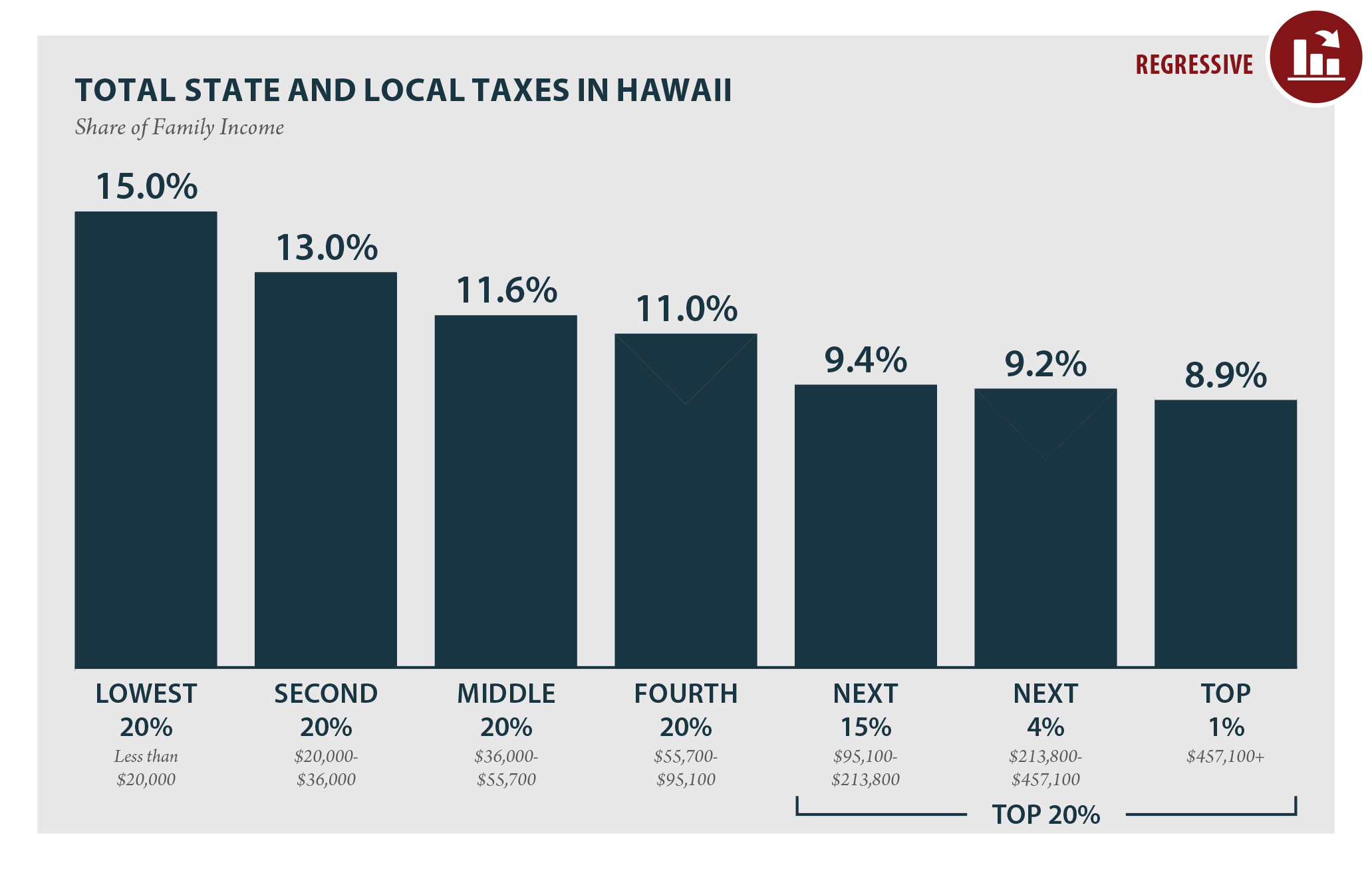

Hawaii Who Pays 6th Edition Itep

Harpta Firpta Tax Withholdings Avoid The Pitfalls Hawaii Living Blog In 2021 Tax Refund Hawaii Real Estate Tax

The Ultimate Guide To Hawaii Real Estate Taxes

Hawaii Who Pays 6th Edition Itep

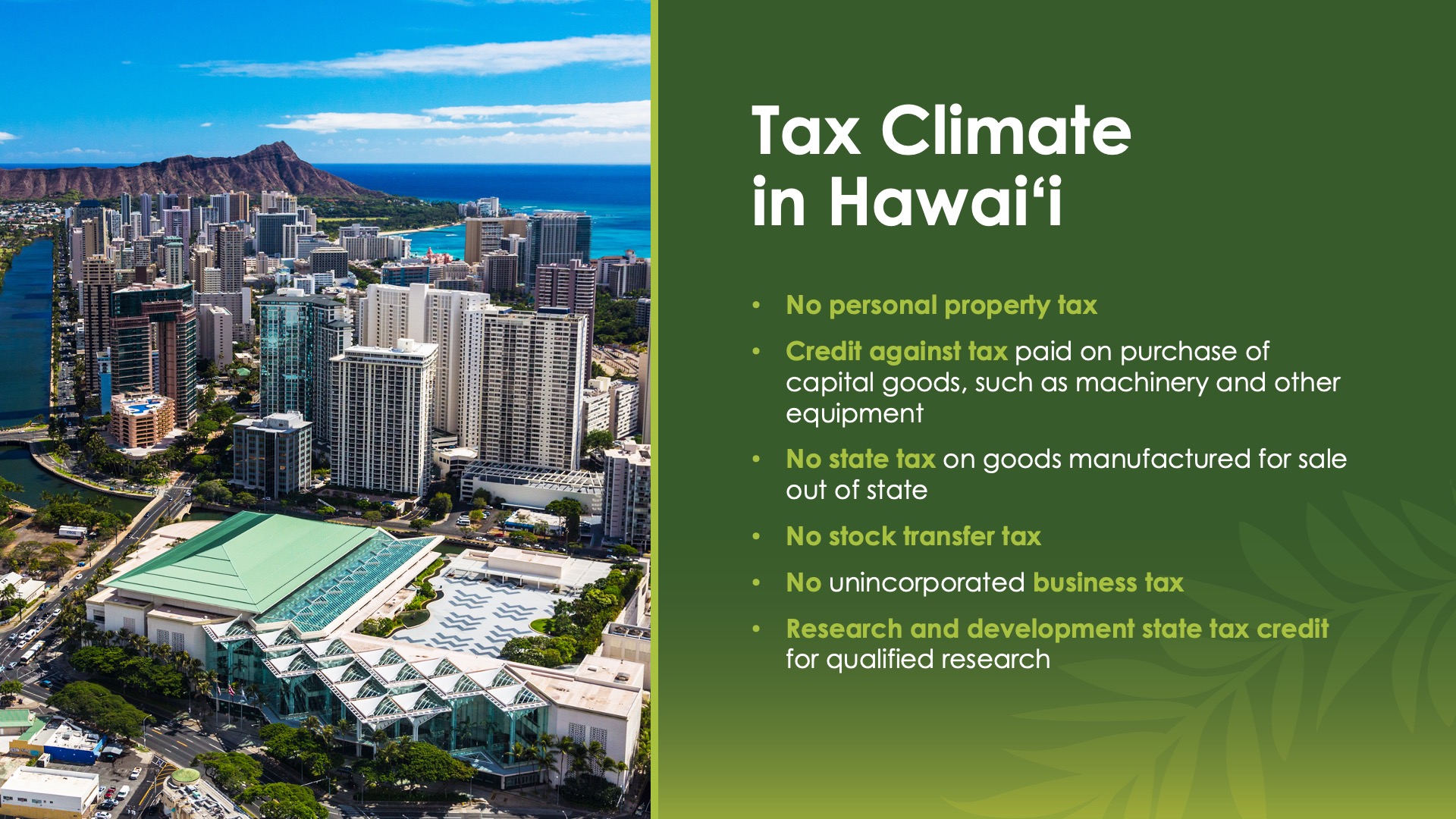

Business Development And Support Division Tax Incentives And Credits

Testimony Sb2485 Cites Tax Fairness In Proposing State Capital Gains Tax Increase Grassroot Institute Of Hawaii

Hawaii Who Pays 6th Edition Itep

Harpta Maui Real Estate Real Estate Marketing Maui

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Hawaii Who Pays 6th Edition Itep

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

Hawaii Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert